on your 1st year’s premium when you quote & buy a new policy online1,4

24/7 claims assistance

Pay by the month at no extra cost6

Cover for your belongings

Insure the belongings kept at the insured address for loss or damage caused by one or more of the insured events.

Policy inclusions

Cover when you’re moving house

Over Fifty’s Contents Insurance will cover your contents for loss or damage caused by an insured event both at your new and old address for up to 14 days after you first start to move. No cover is provided for loss or damage whilst contents are in transit (unless you have Accidental damage cover).

Alternative accommodation for you and your pets

If your contents are damaged by an insured event during the period of insurance to such an extent that you can’t live in your home buildings, Over Fifty Contents Insurance will pay the additional costs for temporary accommodation based on your building’s rentable value prior to the damage, up to 10% of your contents sum insured and up to $500 for temporary accommodation for your pets in commercial boarding establishment. This benefit applies up to a maximum of 12 months.

Guest, visitor and domestic helper property

Over Fifty’s Contents Insurance will also provide cover for property belonging to your guests, visitors and domestic helpers up to $5,000 (included in your contents sum insured), if it is lost or damaged as a result of an insured event that you are claiming for.

Emergency contents storage

If your home buildings are damaged by an insured event and is unable to be lived in, Over Fifty’s Contents insurance will reimburse the reasonable costs to move and store your contents for the time necessary to repair or rebuild your home building or until you find alternative accommodation up to a maximum of 12 months and the remaining balance of your contents sum insured after payment of claim.

Debris removal

In addition to your contents sum insured, Over Fifty Contents Insurance will pay up to 10% of your contents sum insured for the removal of debris from your home buildings if your contents are damaged or destroyed by an insured event.

Food or medicine spoilage

If your refrigerator or freezer breaks down and you lose your perishable food or medicine as a result, Over Fifty’s Contents Insurance will pay for you to replace it. If you claim for this benefit, excess will apply. If the spoilage is due to a natural disaster (declared by Allianz, the government or the Insurance Council of Australia ) the maximum Allianz will pay is $500. No excess will apply.

24/7 claims assistance

When you need to make a claim Over Fifty Insurance are there for you with 24 hour claims lodgement available online, or you can call the claims line to commence the claims process over the phone.

Cover for your contents intended to be kept outside

Over Fifty’s Contents Insurance will cover contents intended to be kept outside like your barbeque, outdoor furniture and childrens play equipment up to $2,000 in total.

Prefer to talk to a real person?

Call our friendly and experienced customer care team (Monday to Friday 8:00am to 6pm AEST)

Policy Documents and Key Fact Sheets

We do not provide advice based on any consideration of your objectives, financial situation or needs. Terms, conditions, limits and exclusions apply. Before making a decision please refer to the Home Product Disclosure Statement (PDS) any applicable supplementary PDS and Home Contents Key Fact Sheet is also available for reference.

Optional covers

Apply to add any of these optional covers for an additional premium and greater cover

Accidental damage

The accidental damage cover option helps insure you in the event of accidental unexpected mishaps that are caused unintentionally – giving you greater coverage for your home contents.

Portable contents

Optional cover to insure your portable contents such as mobile phones, cameras and engagement rings in the event of theft or an accident at the insured address and when you take them out of your home, even when you are temporarily outside Australia for up to 120 continuous days in any period of insurance. Some portable contents must be specified as Listed portable contents with the full replacement value to be covered away from the home

Motor burnout

The Motor burnout option covers you if an electrical current damages your household electrical motors. This cover is automatically included if you have taken optional Accidental Damage cover

Domestic workers’ compensation cover

Cover for a domestic worker (e.g. gardener or cleaner), if they are injured while working for you at the insured address. Only available in ACT and TAS.

What does Contents Insurance cover?

- Fire or smoke (including bushfires and grassfires)7

- Theft or burglary

- Lightning

- Water or other liquid damage

- Impact damage

- Earthquake8 or tsunami

- Accidental breakage of glass or ceramic items

- Vandalism or malicious damage

- Explosion

- Riots or civil commotion

Contents > What’s covered?

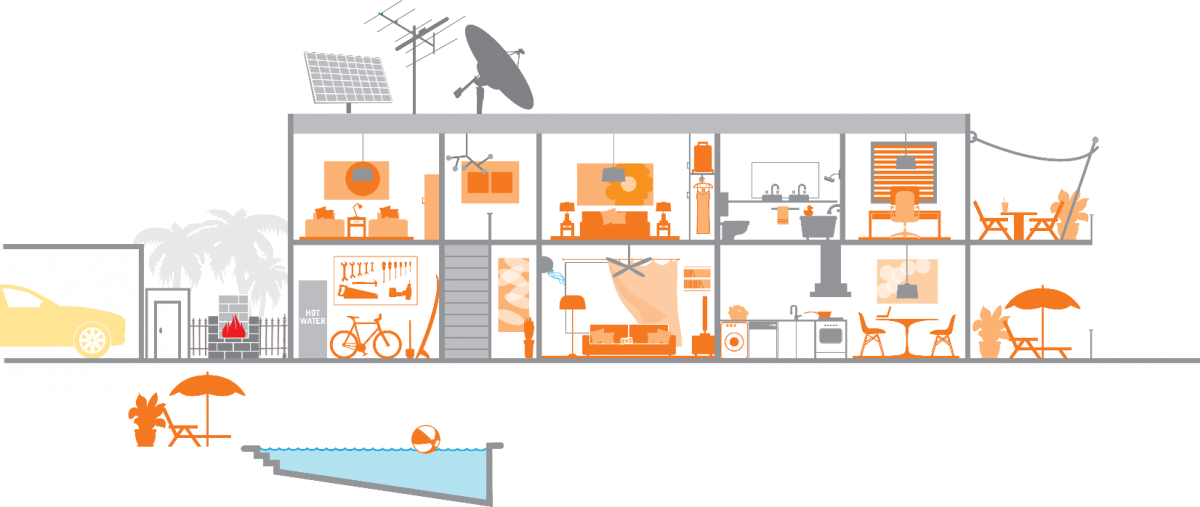

Contents insurance insures the belongings you have at the insured address: from your furniture, carpet and appliances and even your BBQ. So, if any of the insured events happen during the period of insurance, we’ll generally pay to repair or replace your contents – up to the policy limits.

Home Contents Calculator

It’s up to you to decide the sums insured, and the type and level of cover that you want to take out. People generally want enough insurance to cover the property’s estimated replacement value. If you don’t have enough cover, you could end up having to cover some of the costs yourself. Remember, Allianz will only pay up to the amount of your loss or the sum insured, whichever is the lesser (subject to the policy terms and conditions) – so you should also be careful not to over insure. That’s why we’ve provided the calculator. It works as a guide to help you estimate the replacement value of your home contents.

How to make a claim

Make a claim 24/7 using our online claims form or call 13 10 13 to speak to a consultant.

What you need to get started

You’ll need the following details to start your claim. The Claims team will contact you to discuss next steps once your claim is received.

- Your policy information

- Information about the incident, such as the date, where the damage occurred, etc.

- Details about the loss or damage you are claiming for

- Information about any other people, vehicles or property involved.