on your 1st year’s premium when you quote & buy a new policy online1,4

24/7 claims assistance

Pay by the month at no extra cost6

Insure your home inside and out from loss or damage caused by one or more of 11 insured events

Get cover for your home buildings and your contents by combining buildings and contents covers on the one policy.

Policy inclusions

Rebuilding and professional fees

If you need to rebuild your home after total loss or damage, Over Fifty’s Home and Contents Insurance will help pay the reasonable costs of architects, engineers, surveyors and solicitors up to $5,000.

Cover for the unexpected

Over Fifty’s Home and Contents Insurance offers cover for out of the ordinary but devastating events such as fire7, storm7 and burglary.

Making your buildings environmentally friendly

If your buildings are totally destroyed and need to be rebuilt, in addition to your buildings sum insured, Over Fifty’s Home and Contents Insurance will pay up to $5,000 (after deduction of any government or council rebates) to help you make the new buildings more environmentally friendly.

Alternative accommodation for you and your pets

If your Building or Contents are damaged by an insured event during the period of insurance to such an extent that you can’t live in your home buildings, Over Fifty Insurance will pay the additional costs for temporary accommodation based on your building’s rentable value prior to the damage, up to 10% of the building or contents sum insured (as applicable) and up to $500 for temporary accommodation for your pets in a commercial boarding establishment. This benefit applies up to a maximum of 12 months.

Replacement locks

Over Fifty’s Home and Contents Insurance will cover the cost, up to $1,000, to replace the locks or cylinders of any external door or window following an actual or attempted theft or burglary if the key is stolen.

Vandalism or malicious damage

Over Fifty Insurance will cover you for loss or damage caused by vandalism or a malicious act.

Debris removal

In addition to your buildings and/or contents sum insured, Over Fifty’s Home and Contents Insurance will pay up to 10% of your building and/or contents sum insured for the removal of debris from the damaged or destroyed part of the buildings.

24/7 claims assistance

When you need to make a claim Over Fifty Insurance are there for you with 24 hour claims lodgement available online, or you can call the claims line to commence the claims process over the phone

Legal liability

Over Fifty’s Home and Contents Insurance will cover your legal liability up to $20 million for payment of compensation relating to death, bodily injury or illness, and/or physical loss of or damage to property caused by an accident (or series of accidents).

Cover when you’re moving house

Over Fifty’s Home and Contents Insurance will cover your contents for loss or damage caused by an insured event both at your new and old address for up to 14 days after you first start to move. No cover is provided for loss or damage whilst contents are in transit (unless you have Accidental damage cover).

Prefer to talk to a real person?

Call our friendly and experienced customer care team (Monday to Friday 8:00am to 6pm AEST)

Policy Documents and Key Fact Sheets

For full details, of the standard terms, conditions, limits and exclusions that apply please read the Product Disclosure Statement (PDS), any applicable supplementary PDS before making a decision to purchase the insurance. The Home Buildings and Home Contents Key Fact Sheets (KFS) also sets out some information about the cover.

Optional covers

Apply to add any of these optional covers for an additional premium and greater cover

Accidental damage

The accidental damage cover option helps insure you in the event of accidental unexpected mishaps that are caused unintentionally – giving you greater coverage for your home building and/or contents.

Portable contents

You can choose optional cover to insure your portable contents such as mobile phones, cameras and engagement rings in the event of theft or an accident at the insured address and when you take them out of your home, even when you are temporarily outside Australia for up to 120 continuous days in any period of insurance. Some portable contents must be specified as Listed portable contents with the full replacement value to be covered away from the home.

Motor burnout

The Motor burnout option covers you if an electrical current damages your household electrical motors. This cover is automatically included if you have taken optional Accidental Damage cover

Domestic workers’ compensation cover

Cover for a domestic worker (e.g. gardener or cleaner), if they are injured while working for you at the insured address. Only available in ACT and TAS.

What does Home Building and Contents Insurance cover?

- Fire or smoke (including bushfires and grassfires)7

- Theft or burglary

- Lightning

- Water or other liquid damage

- Impact damage

- Earthquake8 or tsunami

- Accidental breakage of glass or ceramic items

- Vandalism or malicious damage

- Explosion

- Riots or civil commotion

Buildings > What’s covered?

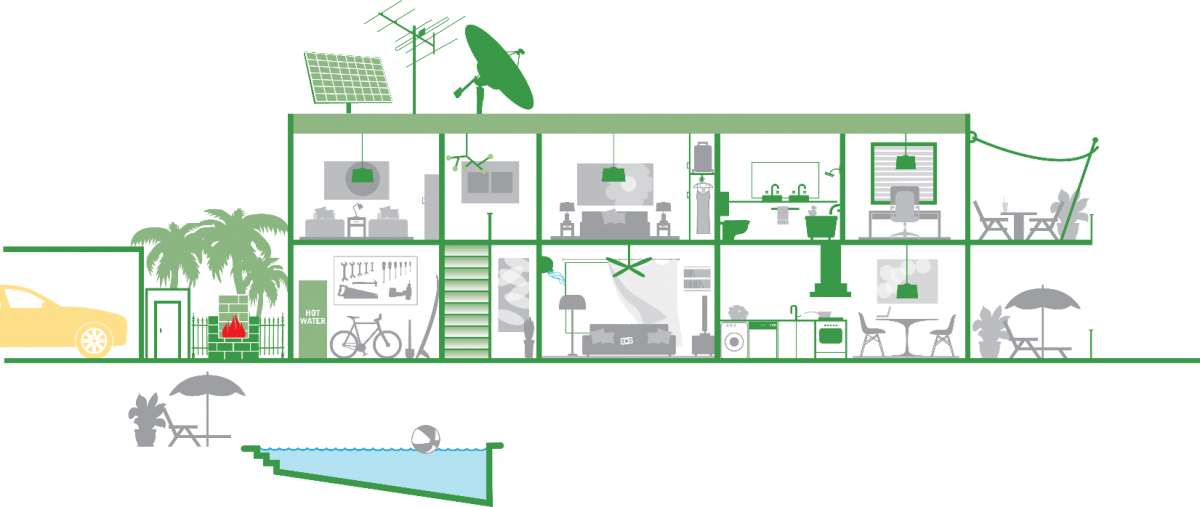

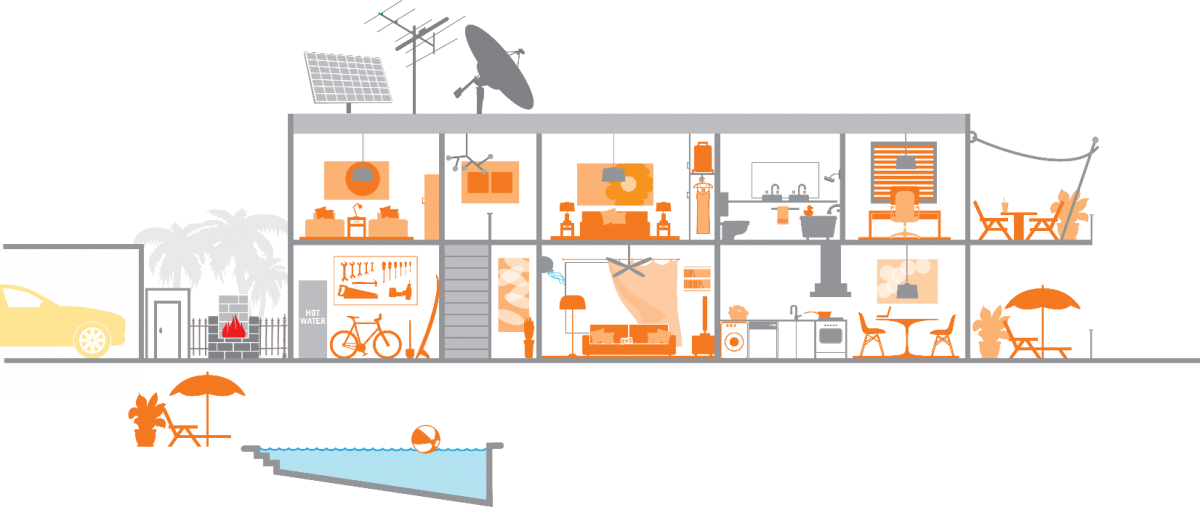

Buildings insurance is designed to insure the physical structures and fixtures that make up your home buildings: from the house itself, to your garage, fences and paved driveways – even built-in appliances like hot water systems, air-conditioners and more.

Contents > What’s covered?

Contents insurance insures the belongings you have at the insured address from your furniture, carpet and appliances and even your BBQ. So, if any of the insured events happen during the period of insurance, we’ll generally pay to repair or replace your contents – up to the policy limits.

Home Insurance Calculator

It’s up to you to decide the sums insured, and the type and level of cover that you want to take out. People generally want enough insurance to cover the property’s estimated replacement value. If you don’t have enough cover, you could end up having to cover some of the costs yourself. Remember, Allianz will only pay up to the amount of your loss or the sum insured, whichever is the lesser (subject to the policy terms and conditions) – so you should also be careful not to over insure. That’s why we’ve provided these calculators. They work as guides to help you estimate the replacement value of your home building and contents.

Home Building replacement calculator

Home Contents replacement calculator

Frequently asked questions

I have commenced using my home for business purposes - should I notify my insurer?

You must tell Allianz as soon as reasonably possible if, during the period of insurance you start using any part of your home building for business, trade or professional purposes (except for a home office).

If you don’t provide this information as soon as reasonably possible, Allianz may refuse or reduce a claim under the policy to the extent Allianz are prejudiced by the delay or the non-disclosure.

When Allianz receive this information, Allianz may:

• propose changes to the terms and conditions of your policy

• charge you a higher premium

• cancel your policy if there is a change and Allianz can’t reach an agreement with you on altered terms and conditions

What do I do if I rent my home out to tenants?

If you’re renting all of your home out to tenants, cover is not available under a Home and Contents Insurance policy. Cover is not available for these types of losses under our Home and Contents Insurance. If you rent out part of your home while you live at the same address, please contact us so we can determine if you are eligible for this product.

I run a business from home, can I get cover?

You must tell Allianz as soon as reasonably possible if, during the period of insurance you start using any part of your home building for business, trade or professional purposes (except for a home office).

If you don’t provide this information as soon as reasonably possible, Allianz may refuse or reduce a claim under the policy to the extent Allianz are prejudiced by the delay or the non-disclosure.

When Allianz receive this information, Allianz may:

• propose changes to the terms and conditions of your policy

• charge you a higher premium

• cancel your policy if there is a change and Allianz can’t reach an agreement with you on altered terms and conditions; or we are no longer prepared to insure you because there has been a material change to the risk

How to make a claim

Make a claim 24/7 using our online claims form or call 13 10 13 to speak to a consultant.

What you need to get started

You’ll need the following details to start your claim. The Claims team will contact you to discuss next steps once your claim is received.

- Your policy information

- Information about the incident, such as the date, where the damage occurred, etc.

- Details about the loss or damage you are claiming for

- Information about any other people, vehicles or property involved.